Filling life science product pipelines to boost grow

Oct 17, 2024 | Life Science

Why we can be optimistic for 2025

At the turn of last year, I wrote an article about the expected slow but steady return of investment into life sciences. There has traditionally been a focus on the amount of IPO activity to fund development stage biotech companies. The IPO window has more or less been closed for an extended period. I mentioned in my previous article that patent expiry is one of the main reasons why big pharma companies acquire biotech firms, sign licencing deals with them, or sponsor co-development projects is to fill their own pipelines. Big pharma has effectively outsourced R&D to biotech and medical device development stage companies.

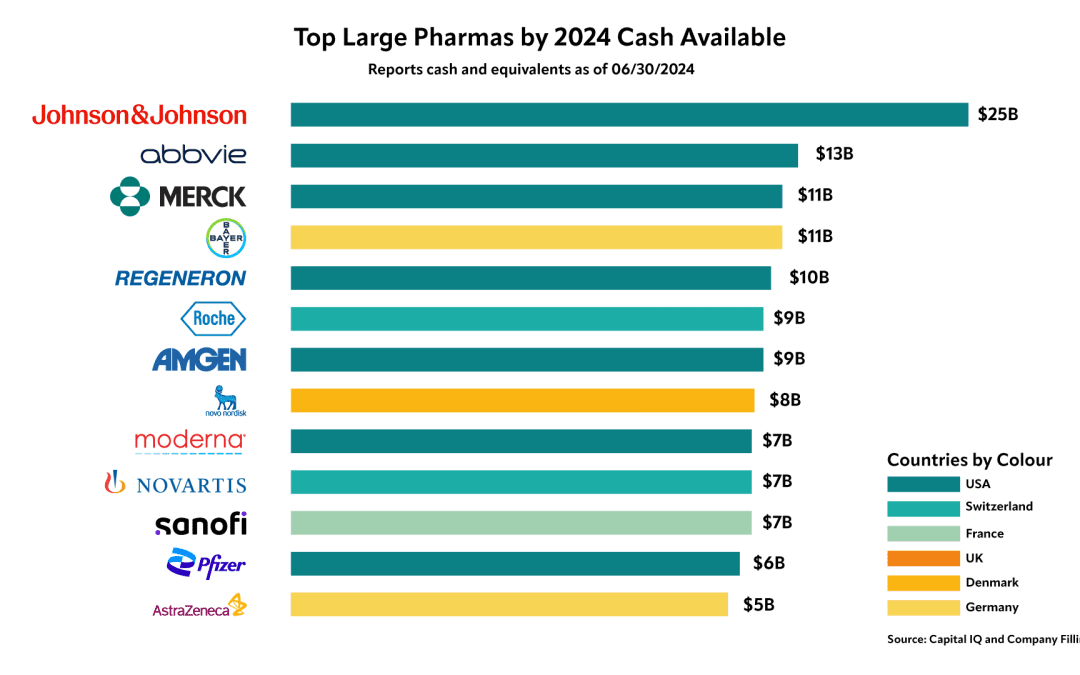

Big pharma companies have big cash reserves, so people often ask why they are not investing in investing when biotech is struggling for funds. Quite simply, plc’s must always act in the shareholder’s interest, and investment in R&D has a high risk profile. When interest rates are high, big pharma will use a significant amount of available funds to secure revenues via money markets. However, as interest rates fall, big pharma will also hit a wall of patent expires.

M&A activity in pharma has been slow in 2024, mirroring 2023, aside from Pfizer’s $43B Seagen acquisition. Large pharmaceutical companies face urgent pressures from both the Inflation Reduction Act (IRA) and the looming loss of exclusivity on key drugs. Loss of exclusivity – patent expiry - will erode revenues as generics enter the market, while the IRA is expected to squeeze pricing. 10 drugs facing patent expiry issues within the next 9 years generated $125B in worldwide sales in 2023.

The attached graph shows the amount of money held by big companies that is potentially available for investment. It would be naïve to assume that this simply means there is $191bn waiting to be spent. Big pharma will still hold significant funds as reserves. The need to refill their product pipeline will – in my opinion -be the thing that drives deals with biotech and medical device/med tech companies. M&A remains essential to fill pipelines and maintain growth. M&A activity will come back. Early signs are emerging, but my sense is that it will be springtime 2025 that we will see a pickup. Increased M&A is usually coincident with confidence returning for IPOs and other market activity.